Date of sending or delivery of the goods or service.ABN for Australian businesses or VAT number for businesses in the EU Tax or company registration details of the seller, if relevant, e.g.Name and contact details of the seller.Tax amounts, if relevant (e.g., GST or VAT).A unique reference number (in case of correspondence about the invoice).

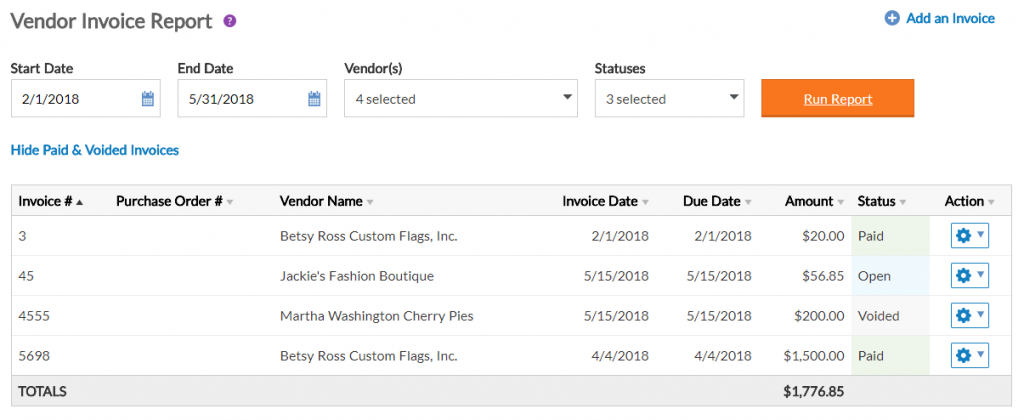

Invoices appear as one of the very earliest manifestations of written records in ancient Mesopotamia. Within the European Union, an invoice is primarily legally defined by the EU VAT directive as an accounting voucher (to verify tax and VAT reporting) and secondly as a Civil law (common law) document.Īn invoice should not be mixed up with Proforma Invoice that indicates commitment, intention, or prepayment request. The document indicates the buyer and seller, but the term invoice indicates money is owed or owing. From a buyer's point of view, an invoice is a purchase invoice. To avoid confusion and consequent unnecessary communications from buyer to seller, some sellers clearly state in large and capital letters on an invoice whether it has already been paid.įrom a seller's point of view, an invoice is a sales invoice. The buyer could have already paid for the products or services listed on the invoice. These may specify that the buyer has a maximum number of days to pay and is sometimes offered a discount if paid before the due date. Payment terms are usually stated on the invoice. For the Japanese company, see Invoice (company).Īn invoice, bill or tab is a commercial document issued by a seller to a buyer relating to a sale transaction and indicating the products, quantities, and agreed-upon prices for products or services the seller had provided the buyer.

0 kommentar(er)

0 kommentar(er)